WHY READ THIS WHITE PAPER:

“Big Data” is here and its acceptance and use is quickly expanding. For example, it’s quite possible for the Social Security Administration to provide W-3 filings which could be linked to 1094 filings and Healthcare.Gov data. When state-based payroll reporting, which includes hours worked data is integrated, the ability for a government agency to make evidence-based inquiries is even easier. When all this data is combined the opportunities to identify disconnects (i.e. audit suspects) is quite real.

Based on our experience with hundreds of clients and prospects, a lot of “what you don’t know you don’t know” thinking exists. Given the complexities that we share in this White Paper, your team/vendor may not have caught everything and penalties will be imminent. Moreover, if things remain status quo, errors that were missed will likely be repeated which will only compound the problem.

Why do these errors exist? It could be any combination of things ranging from data integrity/completeness to ambiguity of the reporting requirements to vendor competence among others. Regardless, a few important questions may come to mind such as:

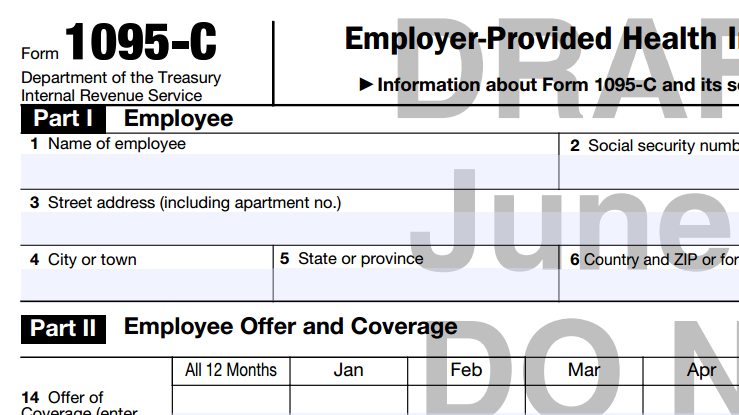

- Did every benefits eligible employee really receive a 1095-C?

- Are the job classifications for each employee accurate?

- Were all subsidiaries and joint ventures (aggregated members) included?

- How accurate were the codes on lines 14and 16?

- What about the monthly premium amount on line 15?

- Were the social security numbers accurate?

- If the plan was self-insured, were all covered individuals included?

If any of this information is wrong and it gets submitted to the IRS, is this going to be a problem for my employer? We primarily address likely audit red flags and the potential risks associated with 3 key 1095-C, Part II reporting requirements: Offers of Coverage, Monthly Premiums and Employee Status.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Legislation